Case Study

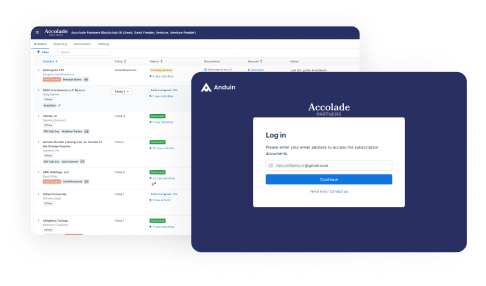

Accolade Partners Raises More Than $1 Billion with Anduin

Streamlined investor onboarding operations led to increased LP activity across multiple Accolade funds

Download Case Study >

Hi! We noticed that your browser has extensions installed that may cause our website to not display or function properly for you.

For best user experience, we highly suggest to turn off ad blockers or privacy trackers (such as Privacy Badger or Firefox Enhanced Tracking).

Thank you.

CASE STUDY

Streamlined investor onboarding operations led to increased LP activity across multiple Accolade funds

Streamlined investor onboarding operations led to increased LP activity across multiple Accolade funds

Download Case Study >

.png)

Accolade Partners is a leading alternative investment firm dedicated to investing in top-tier venture capital, growth equity, and blockchain funds on behalf of endowments, foundations, institutions, and individuals.

Founded in 2000 and located in Washington, D.C., the firm has raised $5.8 billion worth of capital and is a registered investment advisor.

Venture Capital, Growth Equity, and Blockchain Strategies

$5.8 Billion

Washington, D.C.

From their decades of experience, Accolade Partners knew the heights the private markets had been riding wouldn’t last forever. Their consistent and disciplined strategy of building concentrated, high-quality, and complementary portfolios within their sectors of focus had served them well in the past. However, they needed to find new ways to sustain their growth.

Partner and Chief Operating Officer at Accolade, Andrew Salembier, realized the key could be optimizing and streamlining their investor operations to bring on additional investors as well as enabling their existing Limited Partners (LPs) to easily invest across more of their funds.

While the asset management industry can be conservative about adopting new technology, Salembier and the Accolade Team have always pushed for more digital transformation. Through their experience and research, they had three requirements for an investor onboarding solution:

Prior to adopting Anduin, Accolade selected another digital investor onboarding provider. But as their fund launch date neared and implementation dragged on, Accolade realized this provider had overpromised on their ability to meet their desired requirements above. Salembier confided there was “a big disconnect in terms of what we needed, what was shown in the demo, and what the actual product was.”

Undeterred, Salembier and the Accolade Team knew they needed another solution for their raise—and fast. Enter Anduin.

From the beginning, Anduin worked with Accolade to ensure it met all their requirements and was a collaborative, positive experience between the teams.

“Getting started with Anduin’s Fund Subscription was easy,” said Salembier.

“Once the Anduin Team analyzed and digitized our fund subscription documents, it was just a simple review process for us and our legal counsel since our subscription documents stayed more intact with Anduin than other providers,” explained Salembier. “Anduin’s proprietary conditional logic really helped it flow.”

Thanks to the built-in connectivity to Fund Subscription, Accolade also chose to utilize Anduin’s Data Room.

“Data rooms are a dime a dozen, but allowing investors to continue from your data room directly to the fund subscription in one click is unique,” says Salembier. “Add in the ability to provide different access levels to documents for various investor types like Anduin does and you have something special.”

Salembier’s praise for Anduin didn’t stop once onboarding was complete.

As Accolade raised additional funds on Anduin, Investor Access was invaluable to unlock a whole new level of growth. Anduin’s Investor Access allowed Accolade’s LPs to create a saved profile of all their information and AML/KYC docs, which could be reused to subscribe to multiple Accolade funds.

“Anduin has enabled our LPs to invest across our products efficiently and allowed us to broaden our aperture of LPs and commitment sizes if we wish,” shared Salembier. With streamlined operations, Accolade now could easily double or triple their LP base if desired in the future.

While private markets fundraising and performance remained under pressure in 2023, Accolade Partners stood out. They maintained their leadership position in the venture and growth spaces by raising more than $1 billion across three new investment vehicles. Focused on venture capital and growth equity, these fund of funds will infuse capital into the dry market—a testament to Accolade’s strategic vision and team.

The story doesn’t end there. Accolade and Anduin are always striving to optimize and improve the fundraise process. Our teams are already at work designing new CRM integration workflows and exploring how Anduin can deliver a superior experience across institutional, high-net-worth individuals, and RIA investor types for future Accolade funds.

The Uniform Electronic Transactions Act, The U.S. ESIGN act of 2000, eIDAS No 910/2014 from the European Union (Basic and Advanced), Write Once Read Many Archiving (WORM), EU General Data Protection Regulation (GDPR), SOC2 Security, Availability & Confidentiality Type 1.

© 2024 Anduin Transactions. All Rights Reserved.